The selling price variance per unit is calculated by subtracting the actual and budgeted selling prices. It follows the standard formula but ignores the ‘Number of Units Sold’ term. Together, these variances offer a comprehensive view of sales performance, cost of goods sold for cleaning industry enabling businesses to understand the factors driving their revenue and profitability. By regularly analyzing these variances, companies can identify areas for improvement, make informed strategic decisions, and enhance their overall financial health.

Accounting Ratios

Sales volume variance provides insights into market demand and sales effectiveness, while sales price variance highlights the impact of pricing strategies and market conditions on revenue and profitability. In this article, we’ll cover what is a sales volume variance vs a sales price variance. Variance analysis is a fundamental technique in financial management that involves comparing actual financial performance with budgeted or planned performance. By identifying and analyzing the differences between these figures, known as variances, businesses can gain insights into their operational efficiency, cost management, and overall financial health.

How to Calculate Cost of Goods Sold in Your Business

Different from sales price variance, price variance is the true unit cost of a purchased item, minus its standard cost, multiplied by the number of actual units purchased. It’s used in budget preparation and to determine whether certain costs and inventory levels need to be adjusted. Enterprise Resource Planning (ERP) systems like SAP and Oracle provide comprehensive solutions for financial management, including variance analysis. These systems integrate sales data with financial data, enabling real-time tracking and analysis of sales variances. Fluctuations in consumer preferences, trends, and overall economic conditions can significantly impact how many units a business sells.

Examples of Calculating Sales Price Variance

- This negative variance of $3,000 indicates that the company sold fewer units than expected, leading to a shortfall in profits.

- By identifying and analyzing the differences between these figures, known as variances, businesses can gain insights into their operational efficiency, cost management, and overall financial health.

- Conversely, if the product is perceived as less valuable or inferior, the company might need to lower the price to attract buyers.

- Sales Price Variance is the measure of change in sales revenue as a result of variance between actual and standard selling price.

- Similarly, actual sales at budgeted price equals the product of actual units sold and budgeted price per unit.

This price is decided based on the cost of selling the product, the competitor’s selling price, the customer’s expectations, etc. The sales price variance is useful in demonstrating which products are contributing the most to total sales revenue and whether the pricing of certain products is effective. The process of variance analysis typically involves breaking down financial data into various components, such as sales, costs, and profits, and examining each element to understand the reasons behind any discrepancies. This detailed examination helps in identifying trends, uncovering potential issues, and implementing strategies to improve financial performance.

For instance, a successful marketing campaign that resonates with the target audience can lead to a significant boost in sales volume. On the other hand, ineffective or poorly targeted marketing efforts can result in lower than expected sales. The responsibility for a lower sales price variance typically lies with the sales department but the lower than anticipated sales price may be caused by, for example, poor quality, poor planning, unrealistic budgeting etc. In such cases, the responsibility lies with the production, budgeting, etc. Sales Price Variance occurs when the actual selling price of a commodity or service differs from the standard selling price set by the management, which is an estimated selling price decided beforehand.

Components of Sales Volume Variance

If the cost of production increases due to higher raw material prices, labor costs, or overheads, the company might need to adjust its selling price to maintain profit margins. Conversely, if the COGS decreases, the company might lower the selling price to stay competitive or pass on the savings to customers. Competitive pricing can attract price-sensitive customers, leading to higher sales volumes. However, setting prices too low might erode profit margins, while setting them too high could drive customers to competitors. Finding the right balance is crucial for maximizing sales volume and profitability.

Strategies such as premium pricing, discount pricing, penetration pricing, and value-based pricing can all impact the actual selling price. For instance, a company might adopt a discount pricing strategy to attract more customers, which could lead to a lower actual selling price compared to the budgeted price. The formula for calculating sales volume variance is straightforward and involves multiplying the difference between actual units sold and budgeted units sold by the standard profit per unit. The standard profit per unit is typically derived from the budgeted or planned figures. A hotel chain conducted variance analysis to optimize its pricing strategy across different locations. The analysis revealed that certain high-demand locations had a positive sales price variance, indicating that customers were willing to pay higher rates.

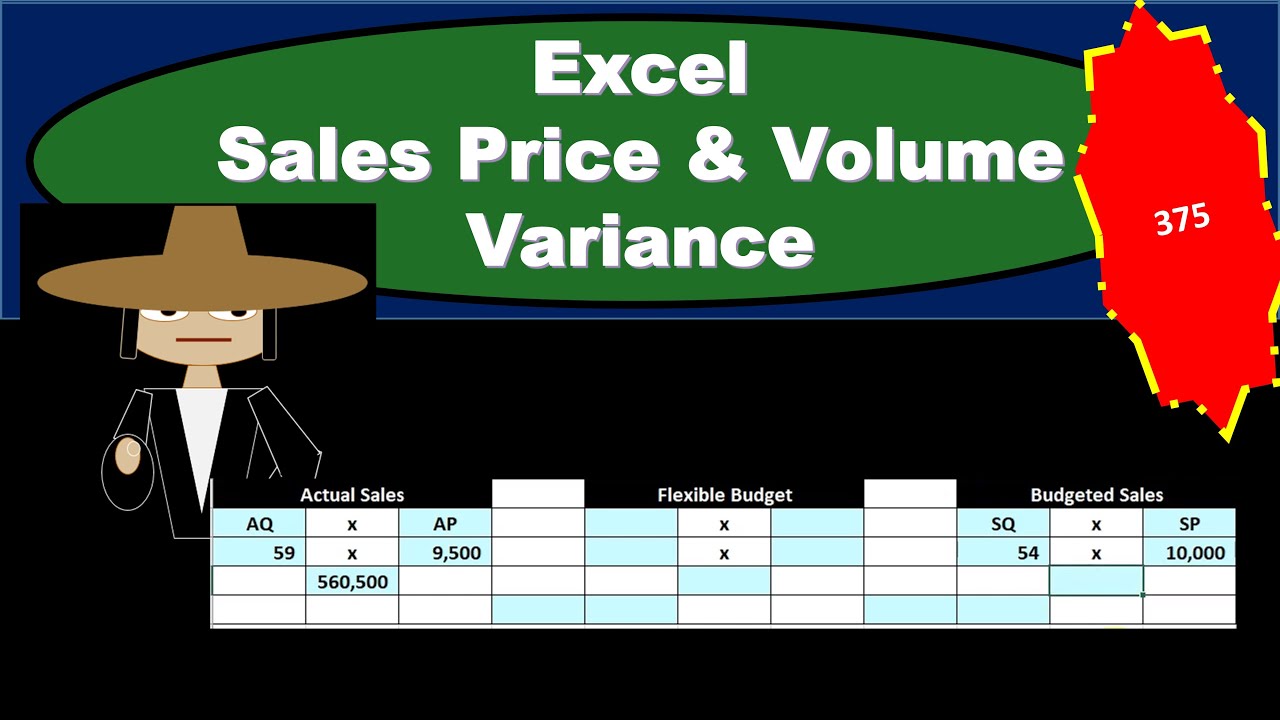

Think about it for a little while, internalize it and if you still do not understand, leave a comment and I will try to explain further. The sales price variance results from the actual price of a sales unit being different from the budgeted (or standard) price. The variance is calculated by taking the difference between the actual price and the budgeted price and multiplying this by the actual sales volume to give a monetary amount. A Sales Price Variance, or a selling price variance, refers to a product’s sales revenue variation due to a difference between its budgeted and actual selling price. This variance can be favorable or unfavorable depending on the increase or decrease in the projected revenue.