In the world of finance, the forex market stands out as a highly liquid and potentially profitable environment for traders. For small investors with limited capital, developing effective forex trading strategies is crucial in order to navigate the complexities of the market and maximize returns on investment. This article explores various strategies and techniques that can empower small traders to achieve their financial goals while managing risk effectively. We will also touch upon essential tools and platforms such as forex trading strategies for small accounts Trading Brokers in India that can enhance the trading experience.

Understanding Forex Trading

The forex market, or foreign exchange market, is the largest financial market in the world, with a daily trading volume exceeding $6 trillion. It involves buying one currency while simultaneously selling another, which creates a foreign exchange pair. For small investors, entering this market can initially seem daunting, but with the right strategies, even those with limited experience can find opportunities to profit.

1. Importance of a Solid Trading Plan

A trading plan is critical for any trader, but it’s especially important for small investors who need to manage their resources carefully. A well-defined trading plan includes:

- Goals: Set clear, achievable financial goals and outline your trading objectives.

- Risk management: Establish how much capital you are willing to risk on each trade and overall.

- Revenue sources: Decide on which currency pairs you will trade, and develop criteria for entry and exit points.

Regularly review and adjust your trading plan based on performance and changing market conditions to stay aligned with your objectives.

2. Risk Management Techniques

Effective risk management is essential in forex trading, especially for small investors who cannot afford significant losses. Here are some techniques to consider:

- Use Stop-Loss Orders: A stop-loss order automatically closes a trade at a predetermined level to minimize losses.

- Position Sizing: Determine the size of your trades based on your account balance and risk tolerance. A common rule is risking no more than 1-2% of your capital on a single trade.

- Diversification: Spread your investments across multiple currency pairs instead of putting all your capital into one trade.

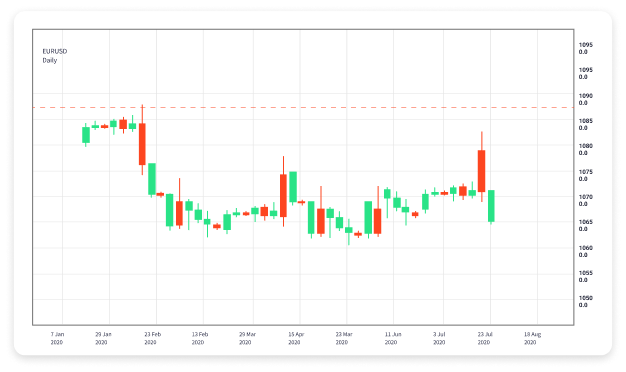

3. Technical Analysis

Technical analysis involves evaluating currency price movements based on historical data using charts and indicators. Small investors can benefit from mastering a few key tools:

- Support and Resistance Levels: Identify critical price points where the market tends to reverse.

- Moving Averages: Use moving averages to recognize trends and smooth out price fluctuations.

- Relative Strength Index (RSI): The RSI helps evaluate whether a currency pair is overbought or oversold, indicating potential reversal points.

4. Fundamental Analysis

While technical analysis focuses on price movements, fundamental analysis examines economic indicators and news events that influence currency values. Key factors to monitor include:

- Interest Rates: Central bank policies and interest rate changes can significantly impact currency strength.

- Economic Indicators: Monitor GDP growth, employment rates, and manufacturing data that reflect economic health.

- Political Stability: Political events and geopolitical tensions can lead to volatility in currency markets.

Combining both technical and fundamental analysis allows small investors to make more informed trading decisions.

5. Choosing the Right Trading Broker

Selecting a reliable forex broker is a vital step for any trader. Look for brokers that offer competitive spreads, a wide range of currency pairs, and robust customer service. Additionally, ensure that the broker is regulated by a reputable financial authority. As mentioned earlier, platforms such as Trading Brokers in India can provide valuable resources and tools for small investors to enhance their trading experience.

6. Implementing a Demo Trading Account

Before risking real money, small investors should consider using a demo trading account. Most reputable brokers offer demo accounts that enable traders to practice their strategies without any financial risk. This practice can help in understanding the trading platform, refining strategies, and gaining confidence in executing trades.

7. Continuous Learning and Adaptation

The financial markets are always evolving, and it’s essential for traders to commit to continuous learning. Stay updated with market news, attend webinars, and read trading books to expand your knowledge. Additionally, regularly review your trades and keep a trading journal to learn from both successes and mistakes.

Conclusion

Forex trading presents unique opportunities and challenges for small investors. By developing a well-thought-out trading plan, practicing sound risk management, utilizing both technical and fundamental analysis, and staying informed about market dynamics, small traders can increase their chances of success. Remember, patience and discipline are key in trading, so stay focused on your long-term goals and be prepared to adapt your strategies as needed. With dedication and the right tools, small investors can thrive in the forex market.